A Simple Solution To Complex Stock Options for Fast-Scaling Companies

Specially designed for seed stage firms and funded scale-ups, Keepr is a SaaS-based employee rewards platform that allows founders to easily share stock options between team leads, employees and contractors.

FEATURES

Even Complex Stock Option Plans Don’t Have to be Complicated

Software-as-a-Service model with zero set-up fee.

AI-powered user validation and anti-fraud checks at point of sign-up.

White-labeled platform that can be tailored to your brand.

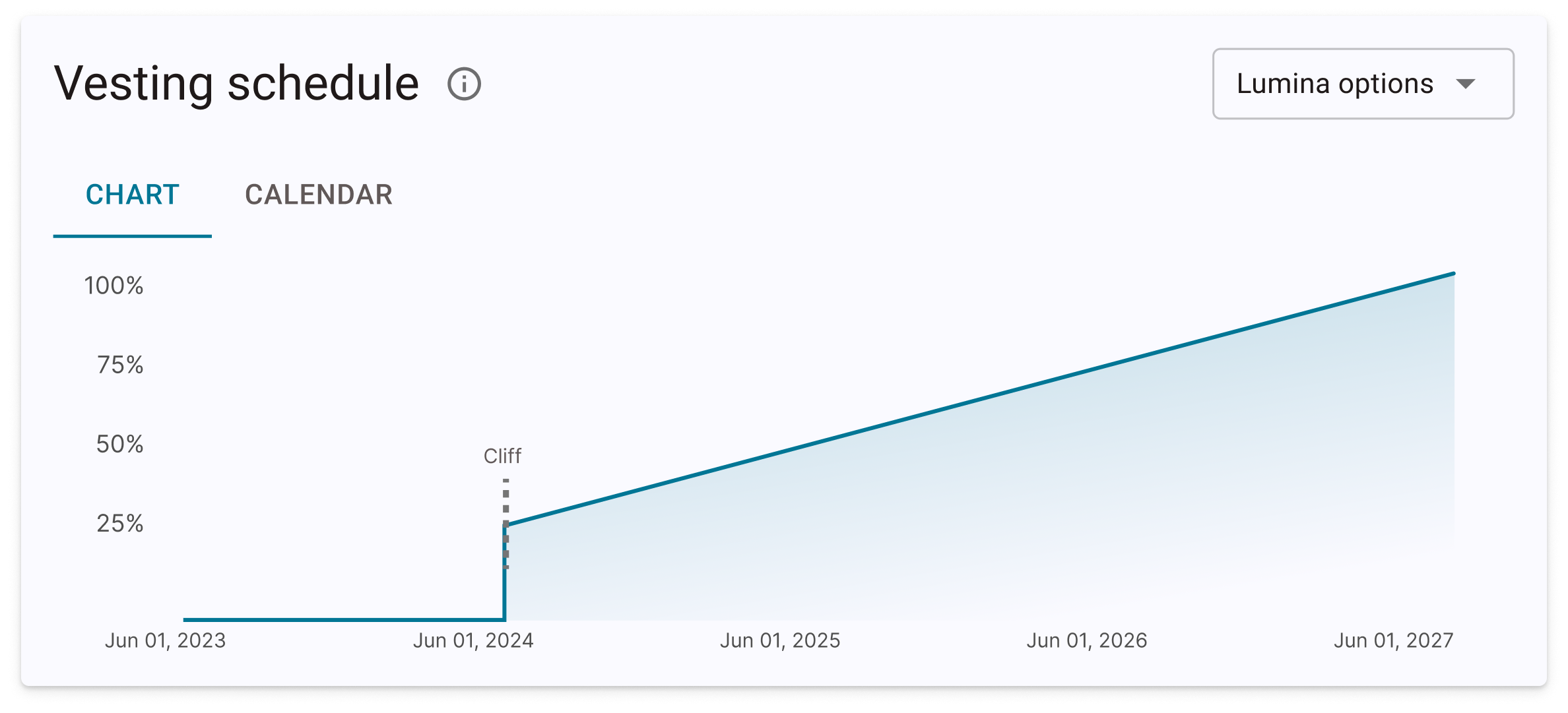

Complete transparency and control over all stakeholder payouts.

‘Founder Studio’ for quick and easy setup of stock incentive plans.

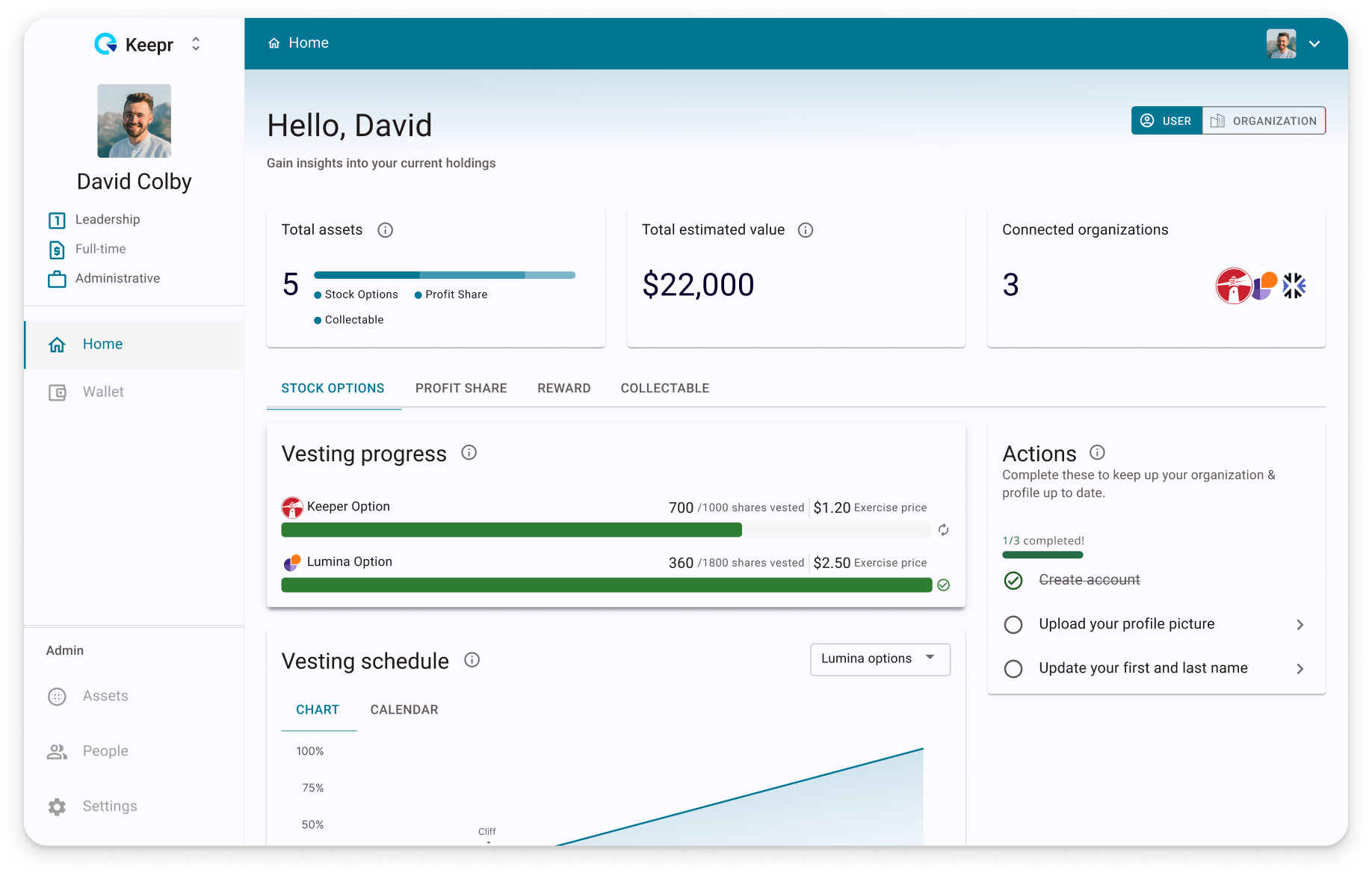

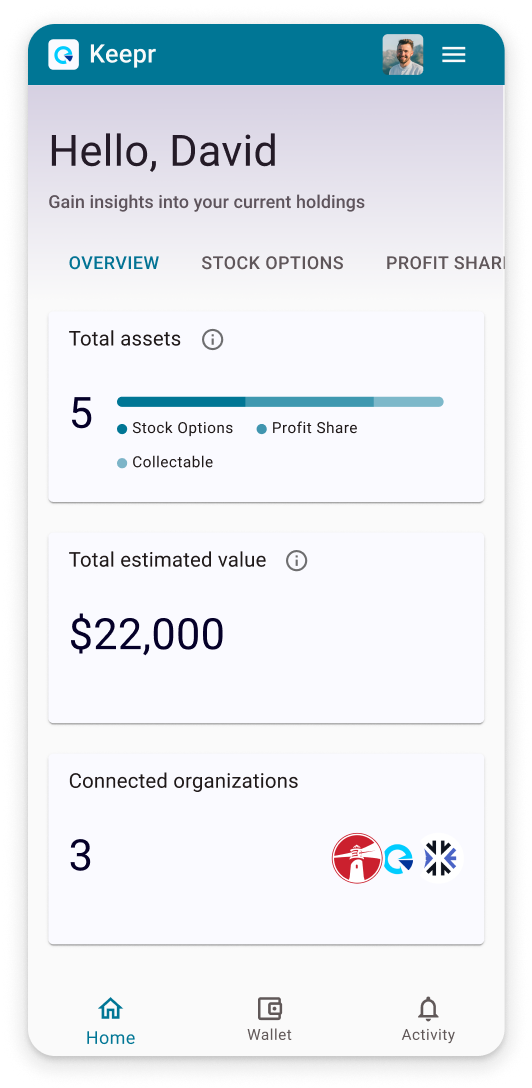

Employee dashboard with

real-time visibility of assets earned.

Tax efficient mechanism for the allocation of stock options.

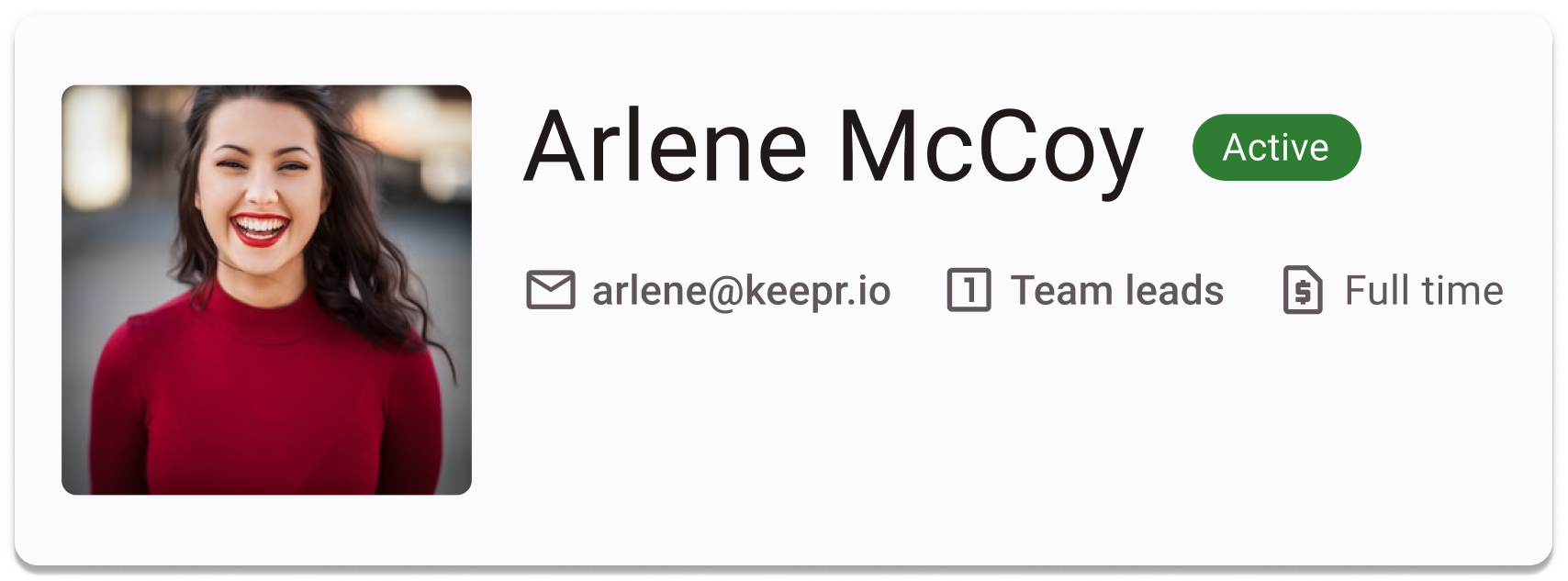

Monthly asset-allocation based on tiered seniority groups.

Employee dashboard with real-time asset visibility.

Easily connect with top cap table management and ERP platforms via API.

Benefits

Built With Start-Ups and Scale-Ups in Mind

Attract, Retain,

and Inspire

Demand for highly-skilled individuals is at an all-time high. Keepr provides companies with an innovative way to attract and retain top talent, allowing them to feel like part-owners of your brand.

Build Closer

Connections

Stock options are not only limited to in-house staff. With Keepr, you can reward members of hybrid and outsourced teams that are contributing to your success. This is much more fitting to the modern business landscape.

Effortless Compliance

From The Ground Up

Keepr seamlessly integrates with US and EU laws, ensuring adherence to regulations and withholding taxes. With Keepr, no tax payments are made until a liquidity event such as a merger, acquisition, profit share or IPO takes place.

Easy-to-Use Stock Option Plans Powered by AI

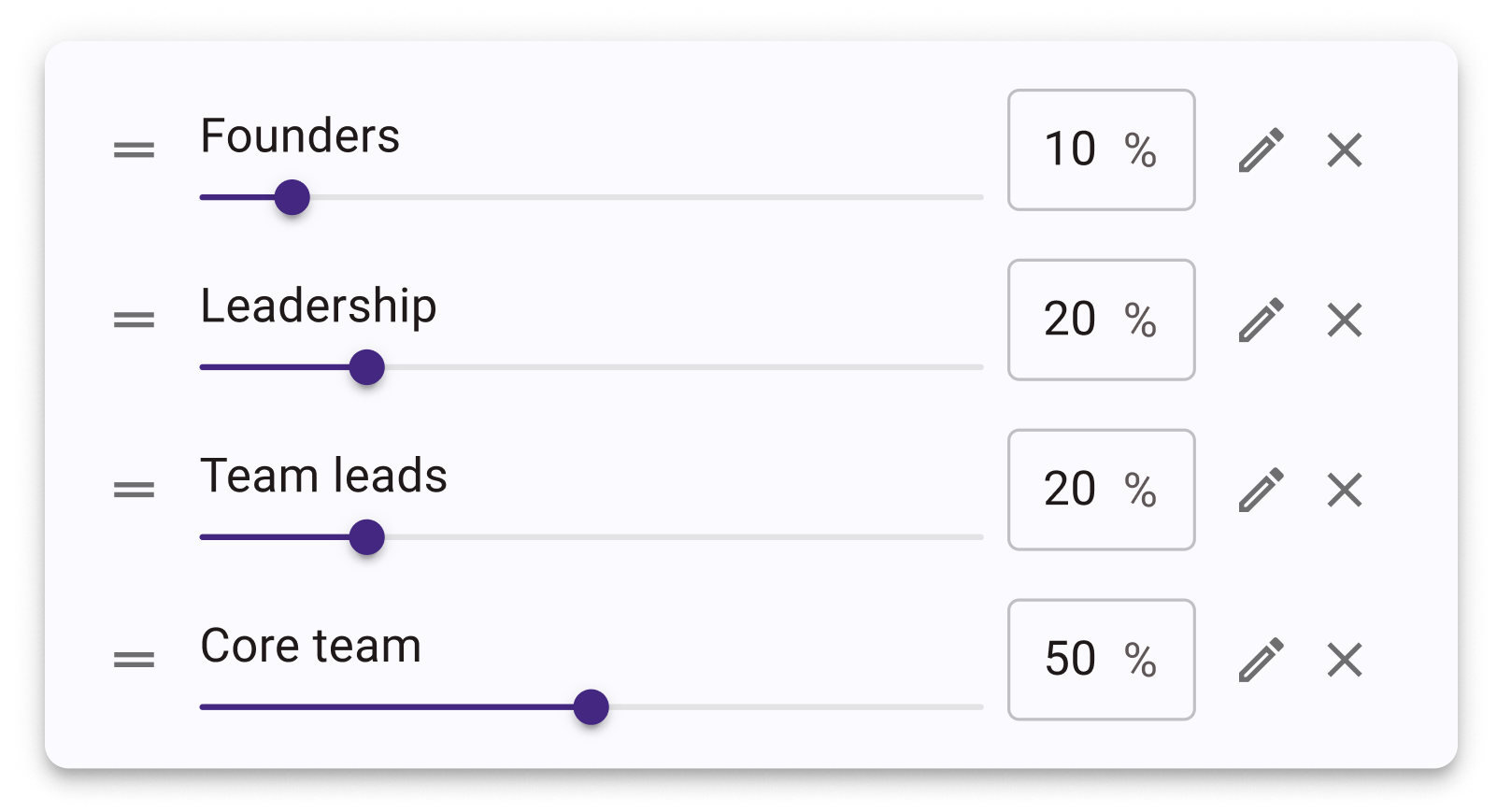

Create tiered allocation groups based on roles and responsibilities. Decide what portion of stock options you want to assign to each group. Then choose initial and monthly allocations, all through a user-friendly dashboard.

Increase Trust

and Engagement

Start-ups often reward senior leadership with stock incentives. Now you can increase financial inclusion by turning the entire team into stakeholders. This allows your business to be more cohesive and aligned.

Manage Your Assets With Ease

Reward your team members, increase team unity and build trust.